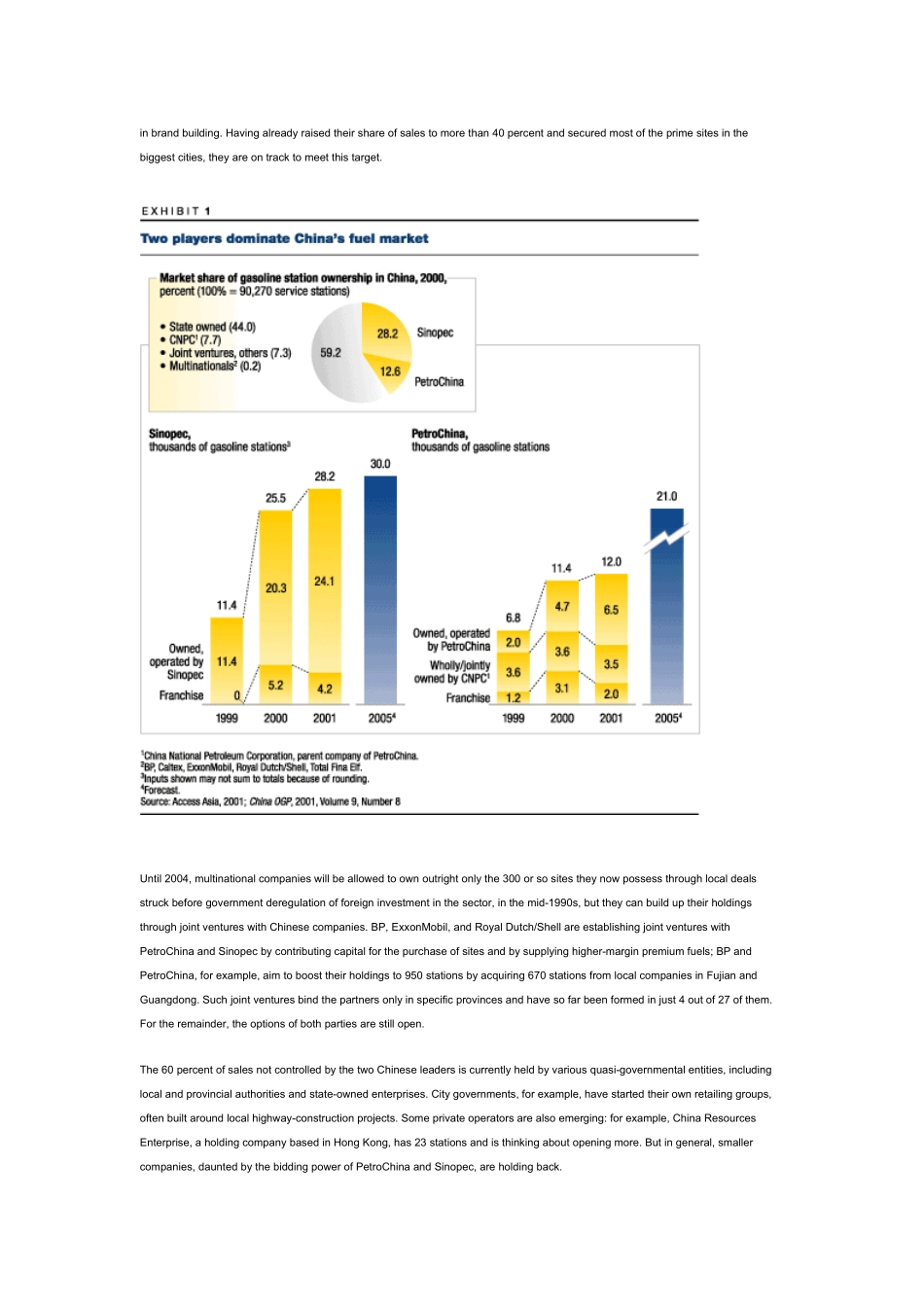

To make money from the expansion of the Chinese market, most oil companies will have to sell much more than gasoline.JONATHAN R. WOETZEL The McKinsey Quarterly, 2002 Number 3CChina 抯 automotive market is predicted to be the third largest in the world by 2008.1 The accompanying growth in demand for gasoline and related car fuel products 梒 ombined with government plans to deregulate the sector and the need to address the chronic inefficiency of current distribution 梥 hould create a juicy opportunity for multinational oil companies as well as for China 抯 two domestic giants, PetroChina and Sinopec.Gasoline reaches the huge Chinese market through a fragmented retail and distribution network of about 90,000 stations, almost all state owned. Many are run more as sinecures than as businesses, often with a staff four to five times larger than the international norm but with less than a quarter of the average gasoline throughput of US stations. The Chinese government, which is well aware of the problem, has resolved not to allow the country 抯 energy infrastructure to burden the whole economy: it is fast deregulating the sector, which will be fully opened up to foreign companies in 2004 under the commitments attending the country 抯 membership in the World Trade Organization (WTO). Foreign oil companies have hitherto been restricted to one-off local deals in special economic zones or tied to investments in toll-road construction.Although the stage should thus be set for canny corporations to move into the market, it remains unclear how they will make money. Competition is already driving down retail margins on gasoline, while prices for the best station sites have soared as China 抯 large domestic...