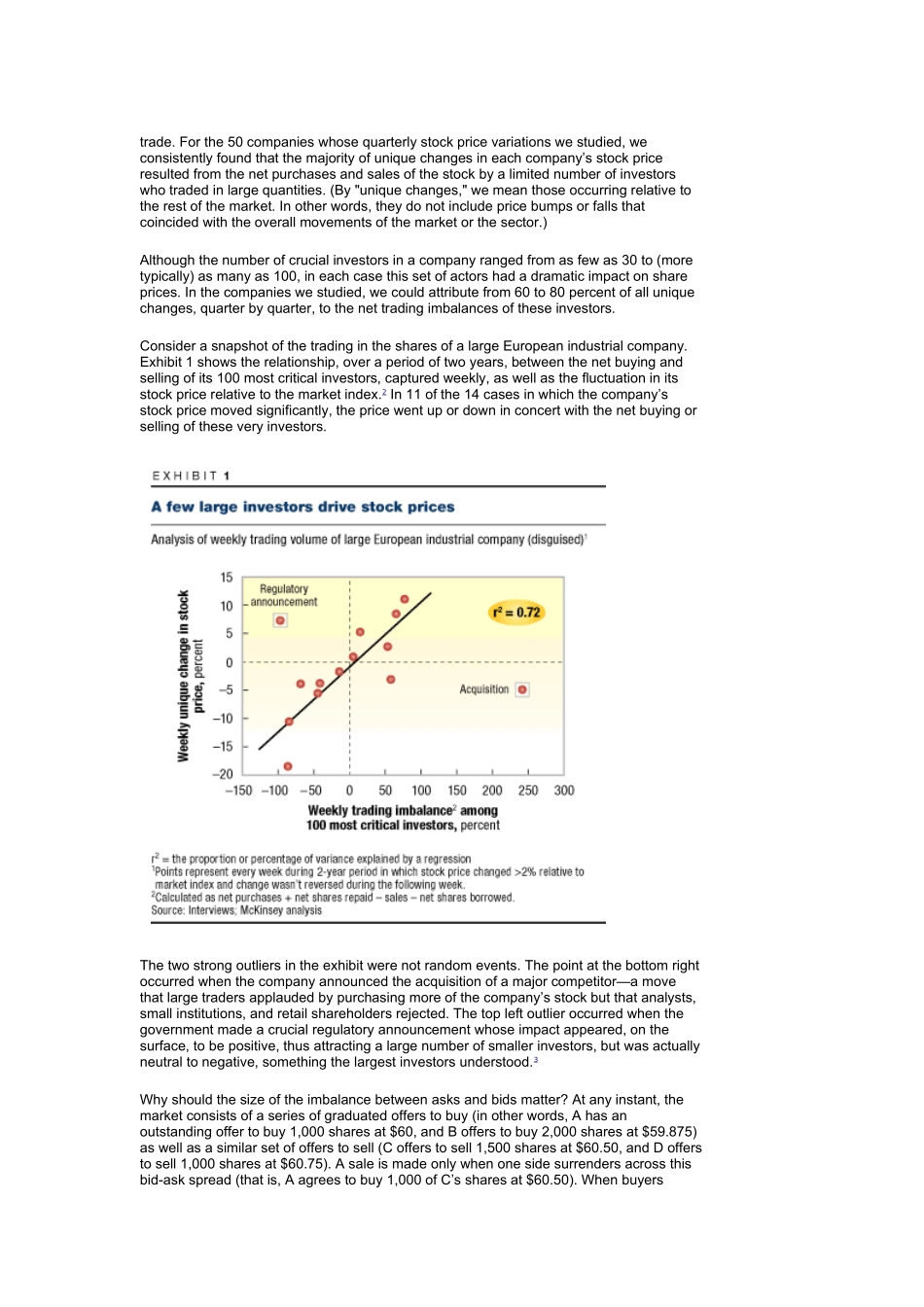

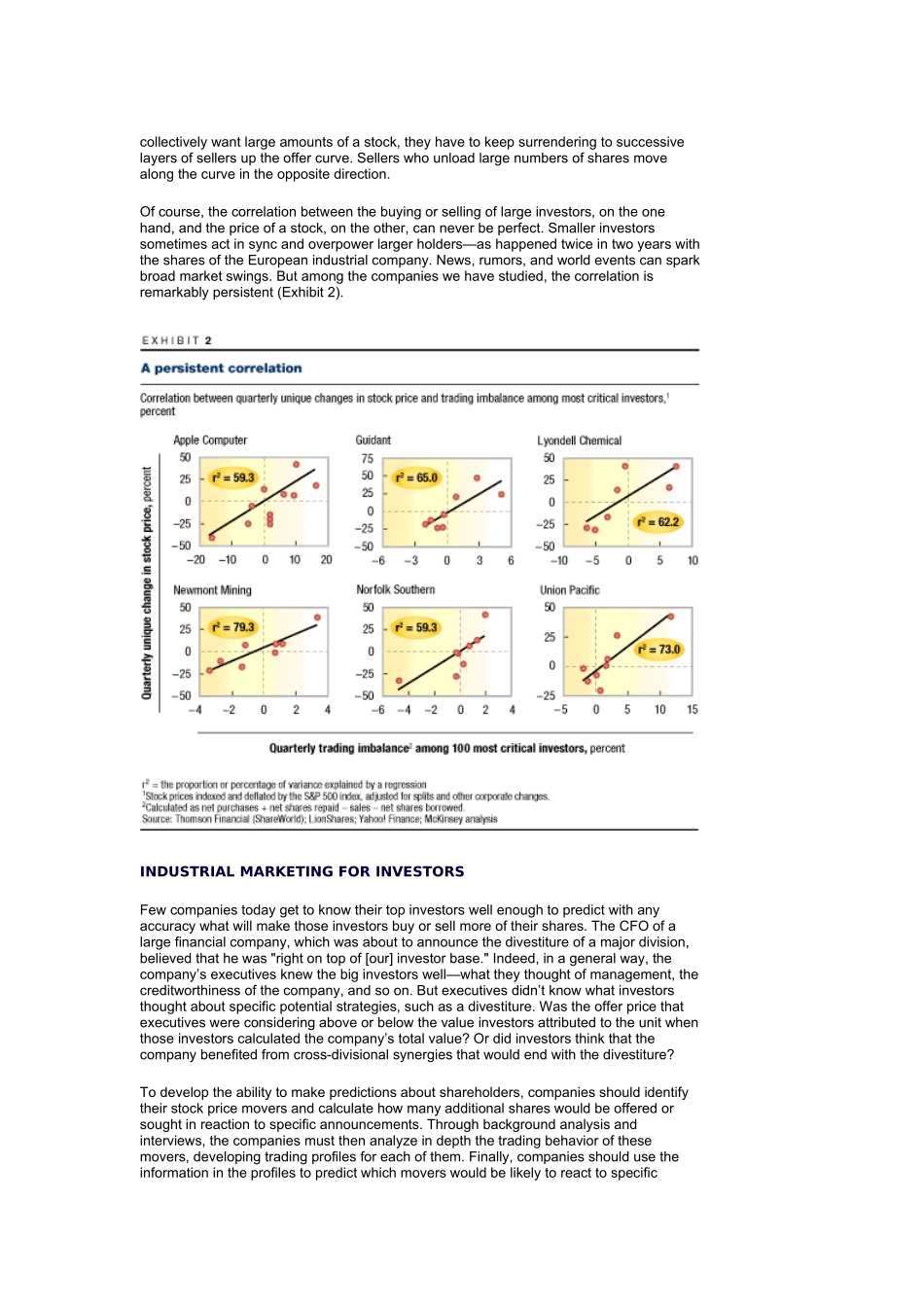

WhatmakesyourstockpricegoupanddownKEVINP.COYNEANDJONATHANW.WITTERTheMcKinseyQuarterly,2002Number2CEOsalwayswanttoknowhowthemarketwillreacttonewstrategiesandothermajordecisions.Willacompany’sshareholdersagreewithaparticularmove,orwilltheyfailtounderstandthemotivesbehinditandpunishthestockaccordingly?Andwhatcanmanagementdotoimprovetheoutcome?Tryingtopredictstockpricemovementsisnecessary,ofcourse.Afterall,whenstockpricesfall,thecostofborrowingandofissuingnewequitycanrise,andfallingstockpricescanbothundercuttheconfidenceofemployeesandcustomersandhandicapmergers.Unfortunately,however,mostofthesepredictionsarenomorethanroughguesses,becausethetoolsCEOsusetomakethemarenotveryaccurate.Netpresentvalue(NPV)maybeusefulforestimatingthelong-termintrinsicvalueofshares,butitisfamouslyunreliableforpredictingtheirpriceoverthenextfewquarters.Conversationswithsamplegroupsofinvestorsandanalysts,conductedbythecompanyorbyinvestmentbankers,arenomorereliableforgaugingmarketreactions.Butexecutivescandramaticallyimprovetheaccuracyoftheirpredictions.Byadoptingamoresystematic,rigorousapproach,corporateleaderscanlearntounderstandindividualinvestorsasthoroughlyasmanycompaniesnowunderstandeachoftheirtopcommercialcustomers.Itispossibletoknowsuchcustomerswellbecausethereareonlysomanyofthem.Equally,onlyafinitenumberofinvestorsreallymatterwhenitcomestopredictingstockpricemovements.EveryCEOknowsthatwhenbuyersaremoreanxioustobuythansellersaretosell,sharepricesrise—andthattheyfallwhenthereversehappens.ButfewerCEOsknowthatnoteverybuyerorsellermattersinthisequation.Ourresearchonthechangingstockpricesofmorethan50largeUSandEuropeanlistedcompaniesovertwoyears1makesitclearthatamaximumofonly100currentandpotentialinvestorssignificantlyinfluencethesharepricesofmostlargecompanies.Byidentifyingthesecriticalindividualinvestorsandunderstandingwhatmotivatesthem,executivescanpredicthowtheywillreacttoannouncements—andmoreaccuratelyestimatethedirectionofstockprices.Armedwiththesenewandsolidinsightsabouthowcriticalinvestorsbehaveinspecificsituations,executivescanmakestrategicdecisionsinadifferentlight.Knowingwhatmakescrucialinvestorsbuy,sell,orholdthecompany’sstockallowsCEOstocalculatewhatitssharepricemightbeafteranannouncementandtofactorthiscalculationintotheirstrategicandoperatingdecisions.Toheadoffshort-termselling,acompanycouldmanagethetiming,pace,orsequencingofstrategicannouncements.Itcouldintroduceanewmanagementteambeforeannouncinganacquisition.Itcouldalsotestanimportantnewproductinselectedmarketsbeforethenationwiderollout.Howwillinvestorsreacttoamergerannouncementandwhatwilltheresultingsharepricemeanforadeal?Howmightaspin-offfareinthemarket?Doesthecompanyneedtopreparethemarketortoconsideracarve-outinstead?ACEOevenhasthechoiceofforgingaheadinthefaceofadversepredictions,usingtheinformationtomanagetheexpectationsoftheboard.Anexecutivemay,forinstance,considerboldstrategieseventhoughtheycouldpushsomecriticalinvestorstosellthecompany’sstock.THEFEWTHATMATTERItshouldcomeasnosurprisethatbigtradescansignificantlymovetheneedleonacompany’sstockprice.WhentheBassfamilyofTexas,forexample,solditsstakeinDisney,inSeptember2001,inresponsetoamargincall,Disney’sstockfellby8percent.Buttypically,short-termchangesinacompany’sstockpricearen’ttheresultofasinglebigtrade.Forthe50companieswhosequarterlystockpricevariationswestudied,wecons...