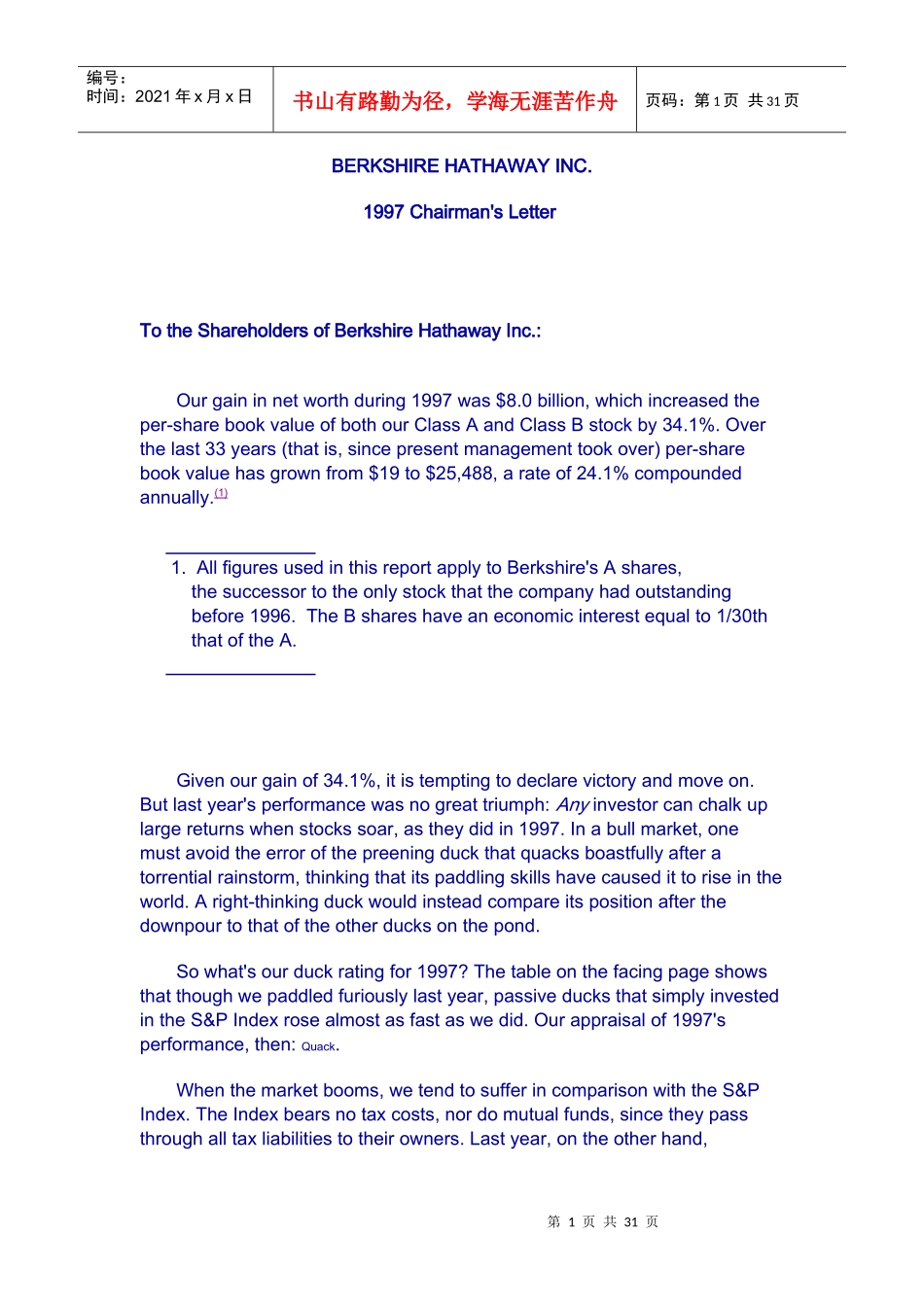

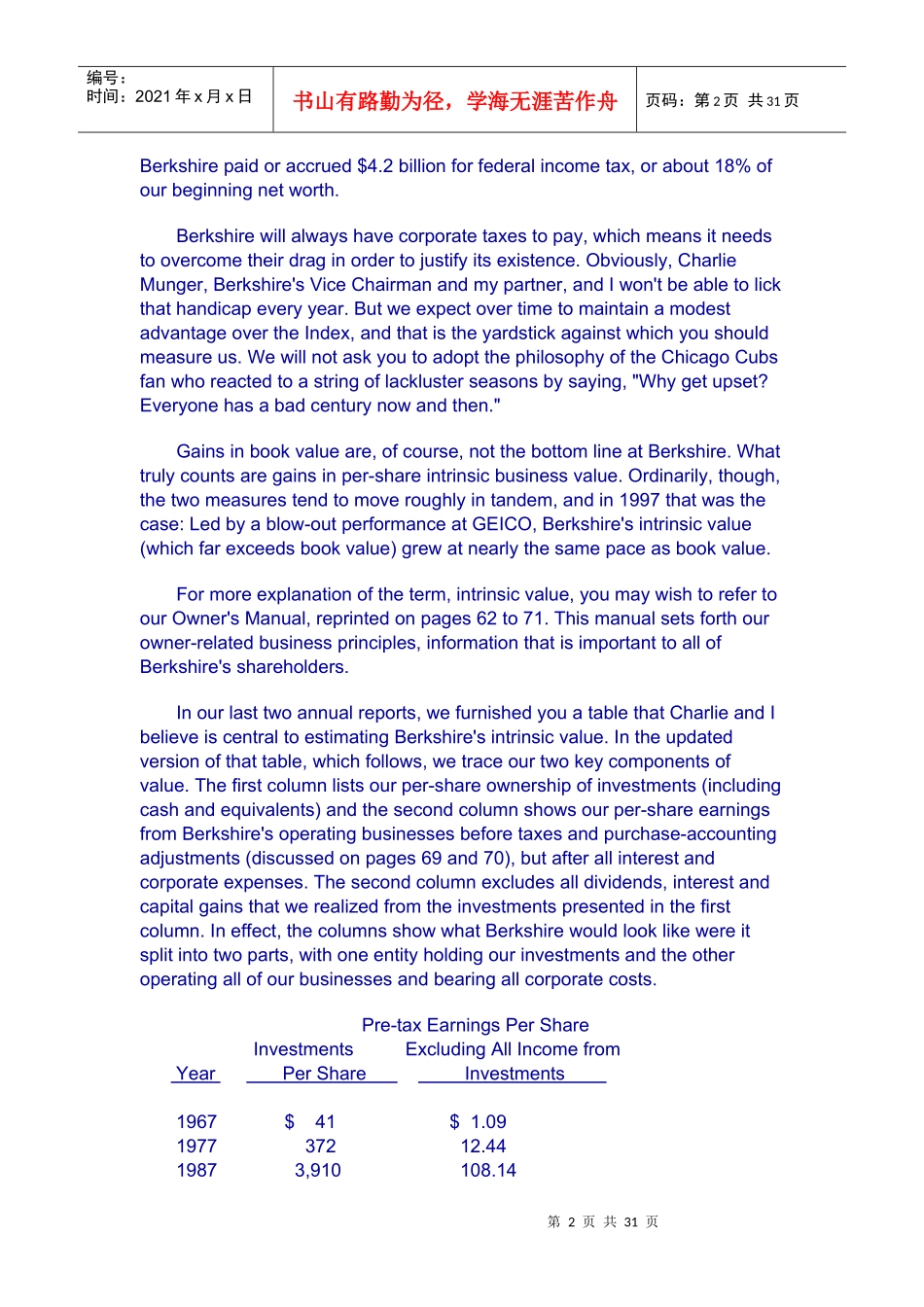

第1页共31页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第1页共31页BERKSHIREHATHAWAYINC.1997Chairman'sLetterTotheShareholdersofBerkshireHathawayInc.:Ourgaininnetworthduring1997was$8.0billion,whichincreasedtheper-sharebookvalueofbothourClassAandClassBstockby34.1%.Overthelast33years(thatis,sincepresentmanagementtookover)per-sharebookvaluehasgrownfrom$19to$25,488,arateof24.1%compoundedannually.(1)1.AllfiguresusedinthisreportapplytoBerkshire'sAshares,thesuccessortotheonlystockthatthecompanyhadoutstandingbefore1996.TheBshareshaveaneconomicinterestequalto1/30ththatoftheA.Givenourgainof34.1%,itistemptingtodeclarevictoryandmoveon.Butlastyear'sperformancewasnogreattriumph:Anyinvestorcanchalkuplargereturnswhenstockssoar,astheydidin1997.Inabullmarket,onemustavoidtheerrorofthepreeningduckthatquacksboastfullyafteratorrentialrainstorm,thinkingthatitspaddlingskillshavecausedittoriseintheworld.Aright-thinkingduckwouldinsteadcompareitspositionafterthedownpourtothatoftheotherducksonthepond.Sowhat'sourduckratingfor1997?Thetableonthefacingpageshowsthatthoughwepaddledfuriouslylastyear,passiveducksthatsimplyinvestedintheS&PIndexrosealmostasfastaswedid.Ourappraisalof1997'sperformance,then:Quack.Whenthemarketbooms,wetendtosufferincomparisonwiththeS&PIndex.TheIndexbearsnotaxcosts,nordomutualfunds,sincetheypassthroughalltaxliabilitiestotheirowners.Lastyear,ontheotherhand,第2页共31页第1页共31页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第2页共31页Berkshirepaidoraccrued$4.2billionforfederalincometax,orabout18%ofourbeginningnetworth.Berkshirewillalwayshavecorporatetaxestopay,whichmeansitneedstoovercometheirdraginordertojustifyitsexistence.Obviously,CharlieMunger,Berkshire'sViceChairmanandmypartner,andIwon'tbeabletolickthathandicapeveryyear.ButweexpectovertimetomaintainamodestadvantageovertheIndex,andthatistheyardstickagainstwhichyoushouldmeasureus.WewillnotaskyoutoadoptthephilosophyoftheChicagoCubsfanwhoreactedtoastringoflacklusterseasonsbysaying,"Whygetupset?Everyonehasabadcenturynowandthen."Gainsinbookvalueare,ofcourse,notthebottomlineatBerkshire.Whattrulycountsaregainsinper-shareintrinsicbusinessvalue.Ordinarily,though,thetwomeasurestendtomoveroughlyintandem,andin1997thatwasthecase:Ledbyablow-outperformanceatGEICO,Berkshire'sintrinsicvalue(whichfarexceedsbookvalue)grewatnearlythesamepaceasbookvalue.Formoreexplanationoftheterm,intrinsicvalue,youmaywishtorefertoourOwner'sManual,reprintedonpages62to71.Thismanualsetsforthourowner-relatedbusinessprinciples,informationthatisimportanttoallofBerkshire'sshareholders.Inourlasttwoannualreports,wefurnishedyouatablethatCharlieandIbelieveiscentraltoestimatingBerkshire'sintrinsicvalue.Intheupdatedversionofthattable,whichfollows,wetraceourtwokeycomponentsofvalue.Thefirstcolumnlistsourper-shareownershipofinvestments(includingcashandequivalents)andthesecondcolumnshowsourper-shareearningsfromBerkshire'soperatingbusinessesbeforetaxesandpurchase-accountingadjustments(discussedonpages69and70),butafterallinterestandcorporateexpenses.Thesecondcolumnexcludesalldividends,interestandcapitalgainsthatwerealizedfromtheinvestmentspresentedinthefirstcolumn.Ineffect,thecolumnsshowwhatBerkshirewouldlooklikewereitsplitintotwoparts,withoneentityholdingourinvestmentsandtheotheroperatingallofourbusinessesandbearingallcorporatecosts.Pre-taxEarningsPerS...

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP