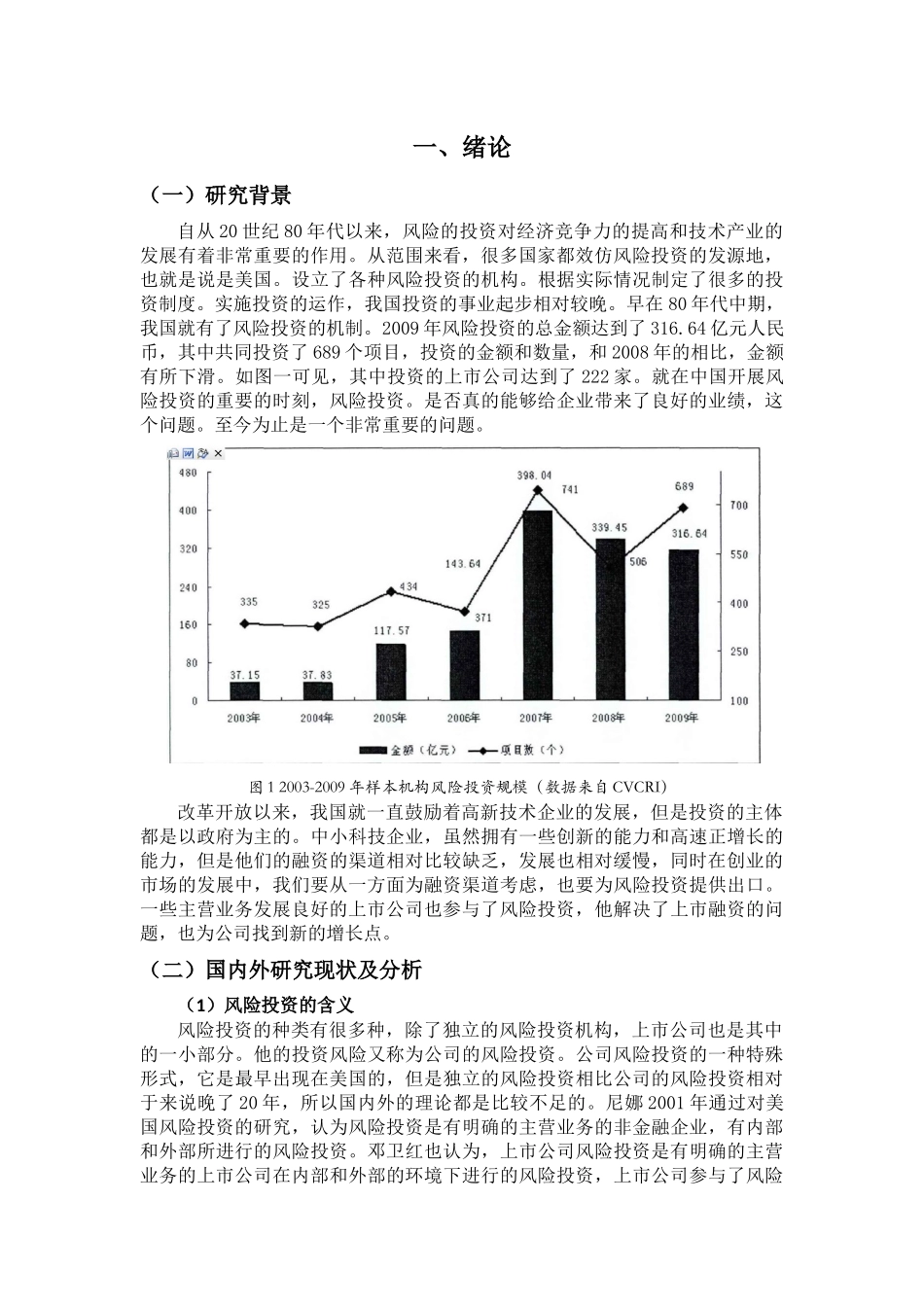

浅析雅戈尔集团基金的股票投资策略摘要:我们在经济全球化的背景下,发展高新的技术产业是提高财务竞争力的重要步骤之一,投资是有风险的,它往往能够给高新技术产业的发展,激发企业的创新能力,有助于企业提升财务竞争力。在我国,都会比较支持高新技术。但是渠道缺乏,发展的比较缓慢,此时一些主营业务的发展比较良好,现金流也比较稳定的上市公司也参加了风险投资,这这不仅解决了大量的资金的问题,也通过多元化的投资战略,为企业带来了 增长点。本文主要通过比较归纳,案例分析等方法,首先分手我国上市公司的。风险投资的动因,模式具备的优势和发展存在的问题,然后通过雅戈尔集团为例,在国资颁布的中央企业综合评价体系为标准分析了上市公司参与投资的影响基于分析提出了上市公司参与风险投资的建议和措施。为以后的发展了解到自己的方向。关键词:上市公司;风险投资;公司绩效Analysis on the Stock Investment Strategy of Youngor Group FundABSTRACT:Development of high-tech industry is the main way to increase national competitiveness under the Economic Globalization. Venture capital not only able to fund for the development of high-tech industries, but also stimulate the innovation spirit of enterprise, Improve the competitiveness of enterprises. China has been encouraging the development of high-tech enterprises, but its lack of financing leads slow development. At this point, some listed companies with good cash flow and stable development have begun to engage in risk investment. This not only solves the problem of idle funds, but also through a wide range of business investment strategy for the enterprises to find new business growth. In this paper, the author use comparison, induction and case analysis to analyze the reasons and models of venture capital of China's listed companies, and the advantages and problems in the development process. Through a case study of Youngor group. Use the central enterprise performance evaluation system that issued by...