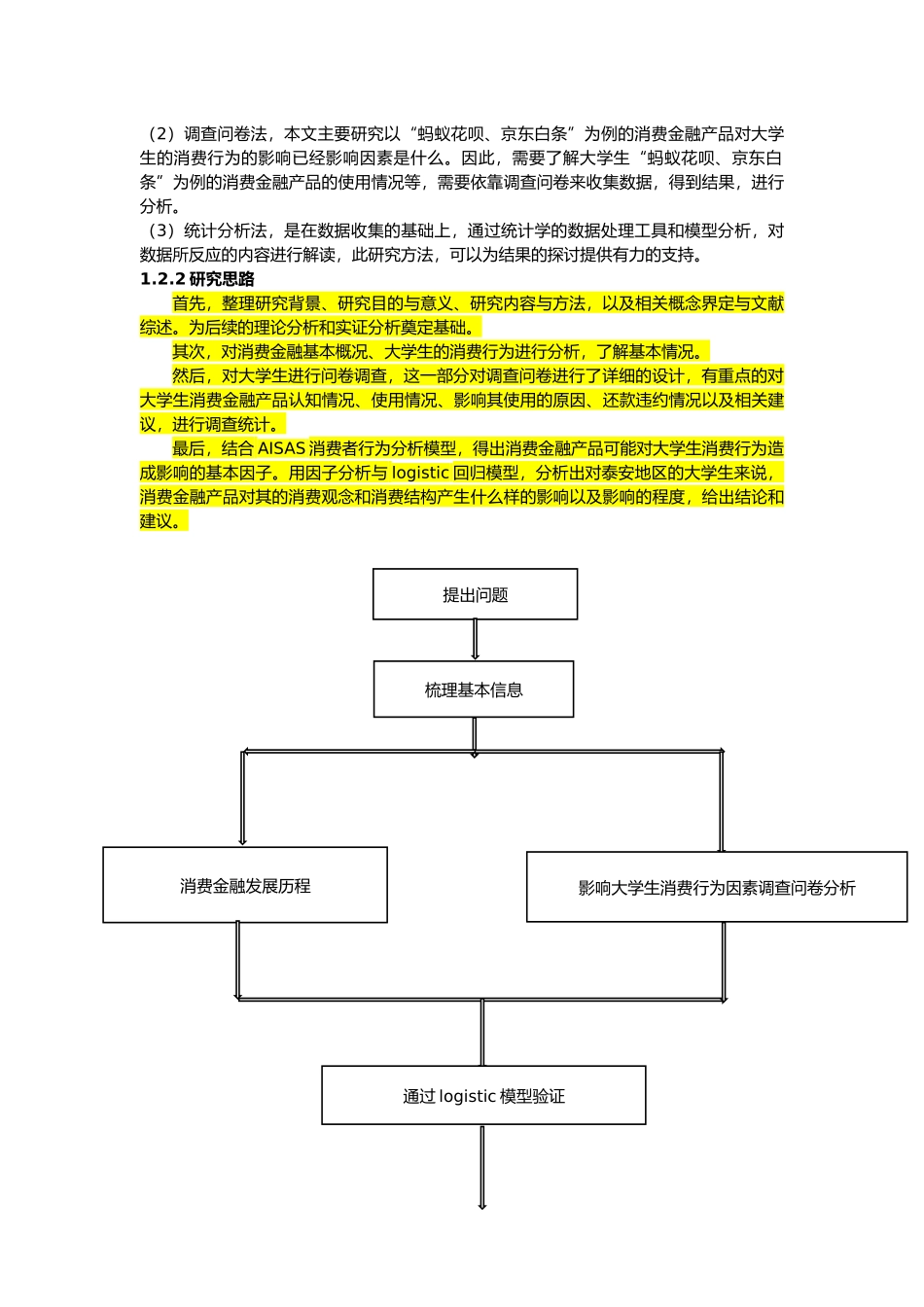

摘要随着经济的快速发展,消费金融业务的不断创新,并与互联网相结合衍生出互联网消费金融。于此同时,居民收入不断增长,人们的消费观念发生改变,当代大学生作为接受新鲜事物能力强且无固定收入的群体,又有着较强的消费欲望,传统的消费金融产品门槛较高,互联网消费金融产品为无固定收入来源的大学生提供了资金来源渠道,给大学生群体的消费行为带来了一定的影响;但也存在不良的消费金融产品在大学生中散播,“校园贷”、”裸贷“等层出不穷,使得大学生的人身安全得不到保证。本论文选取”蚂蚁花呗、京东白条“等正规消费金融产品,以泰安地区高校大学生作为样本抽取对象,通过发放调查问卷的方式,对大学生使用消费金融产品的现状、原因、影响等方面进行调查。然后将调查显示结果与 AISAS 消费者行为模型相结合,分析其影响因素。再将出的影响因素运用 logistic 回归模型,将消费金融产品对大学生消费行为的影响从消费结构、消费能力、消费观念三个方面进行分析。最后总结出消费金融产品对大学生消费行为的具体影响,从国家、消费金融平台、大学生自身等三个方面提出相关的建议使得消费金融产品更好的适应大学生这一群体以及帮助大学生树立正确的消费观。关键词:互联网消费金融,大学生消费行为AbstractWith the rapid development of economy and the continuous innovation of science and technology, the consumer finance business continues to develop, and the combination of Internet and derived Internet consumer finance. At the same time, with the continuous growth of residents' income, people's consumption concept has changed. As a group with strong ability to accept new things, contemporary college students have strong desire for consumption. The threshold of traditional consumer financial products is high. Internet consumer financial products provide a source of funds for college students without fixed income sources, which brings a certain degree of consumer behavior to college students But there are also bad consumer financial products spread among college students, "campus loan" and "naked loan" emerge in an endless stream,...