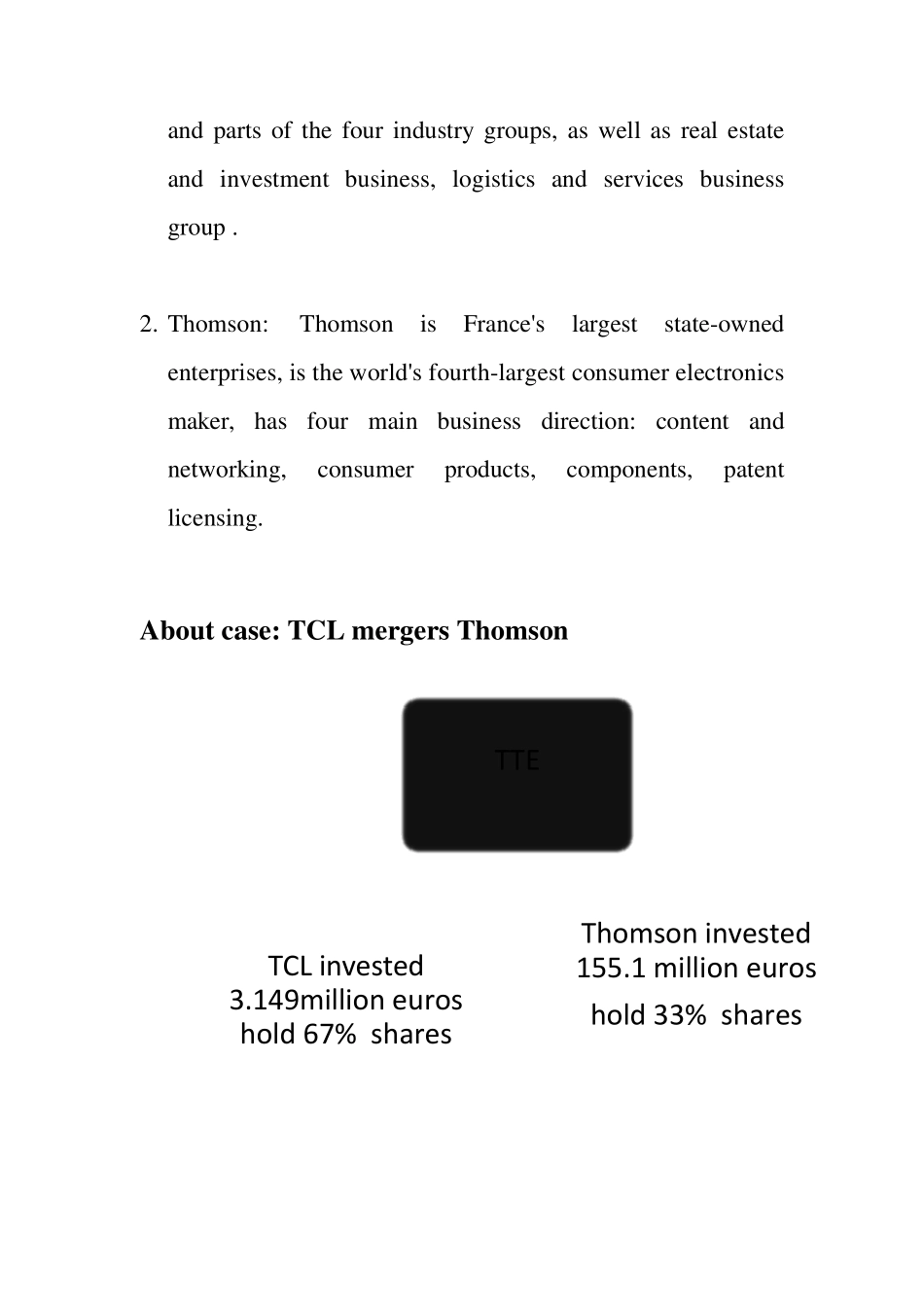

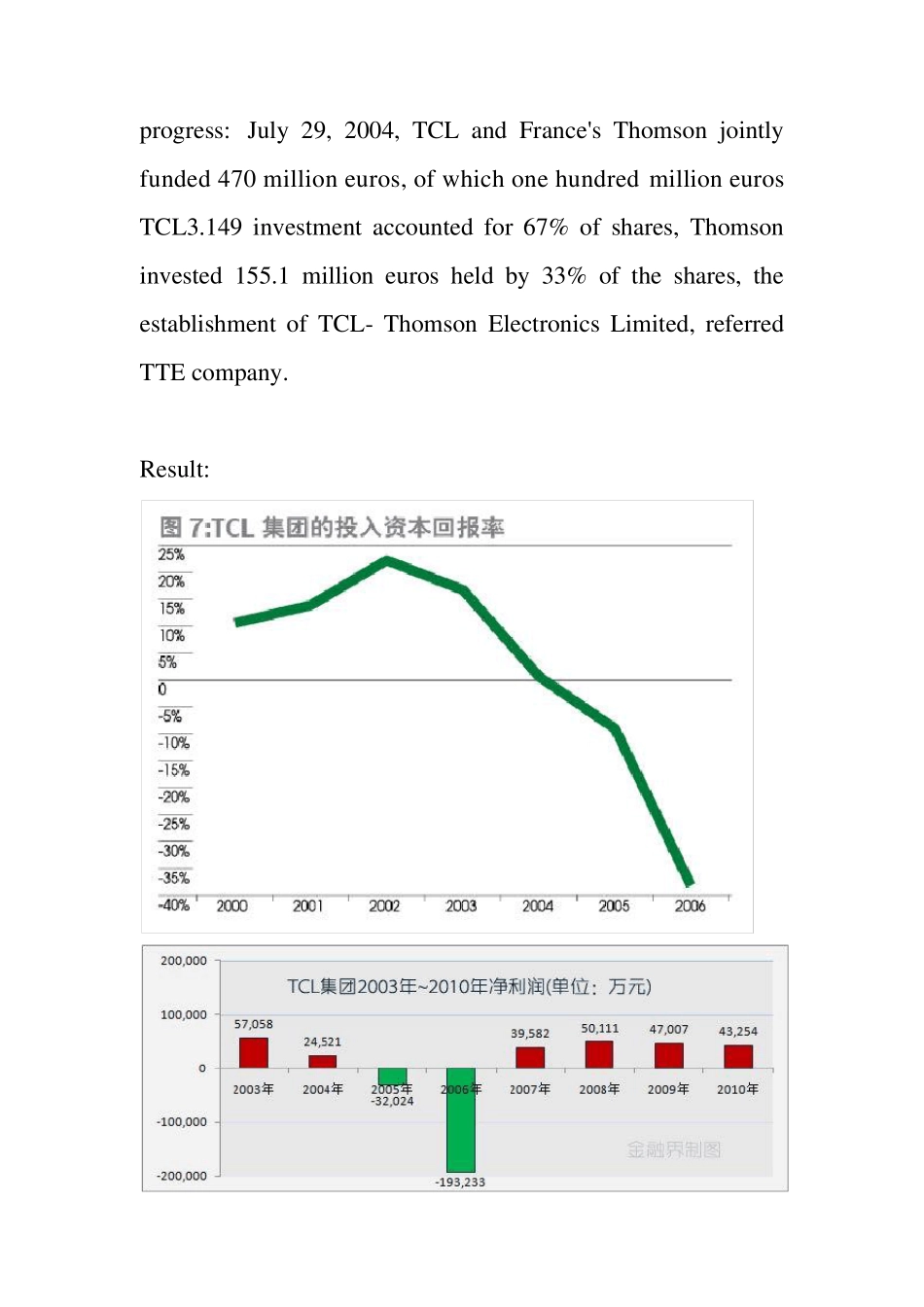

一、Abou t M&A Merger: combination of two or more corporations. Acquisition: the act of contracting or assuming or acquiring possession of something. Merger refers to an enterprise to take various forms for receiving the property rights of other enterprises, so that the merged party lost the qualifications of a legal person or legal entity economic behavior change. Acquisition refers to an enterprise can through the purchase of shares of listed companies and the companies operating decisions change behavior In my opinion, merger is one commercial company could totally control the other company. acquisition is one commercial company own the other company. 二、Case:TCL mergers Thomson Background information: 1. TCL: TCL Group Co., Ltd. was founded in 1981, is one of the consumer electronics business groups worldwide scale, forming a multi-media, telecommunications, home appliances, and parts of the four industry groups, as well as real estate and investment business, logistics and services business group . 2. Thomson: Thomson is France's largest state-owned enterprises, is the world's fourth-largest consumer electronics maker, has four main business direction: content and networking, consumer products, components, patent licensing. Abou t case: TCL mergers Thomson TTETCL invested3.149million euros hold 67% sharesThomson invested 155.1 million euroshold 33% shares progress: July 29, 2004, TCL and France's Thomson jointly funded 470 million euros, of which one hundred million euros TCL3.149 investment accounted for 67% of shares, Thomson invested 155.1 million euros held by 33% of the shares, the establishment of TCL- Thomson Electronics Limited, referred TTE company. Result: By the end of 2004, the European business...