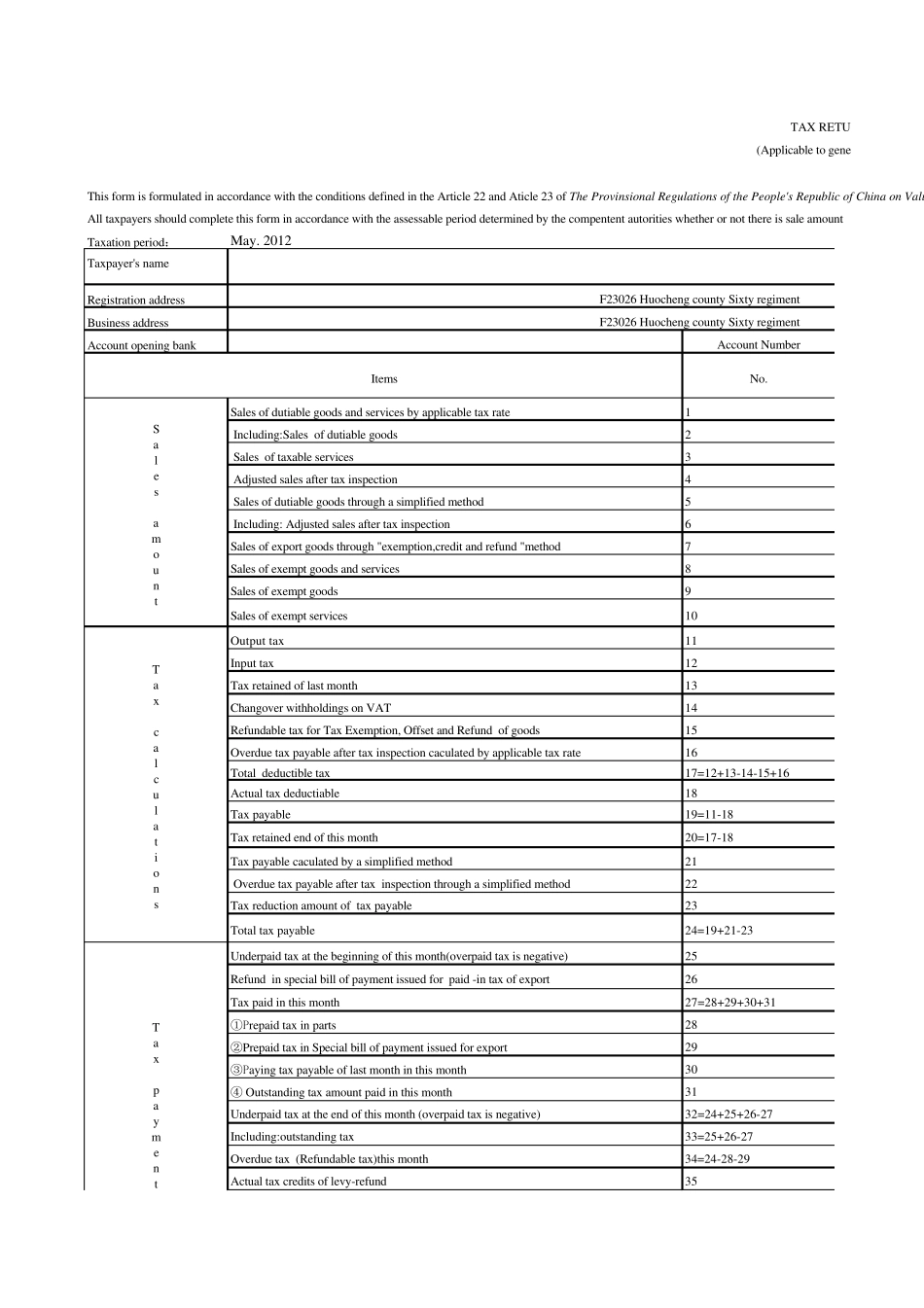

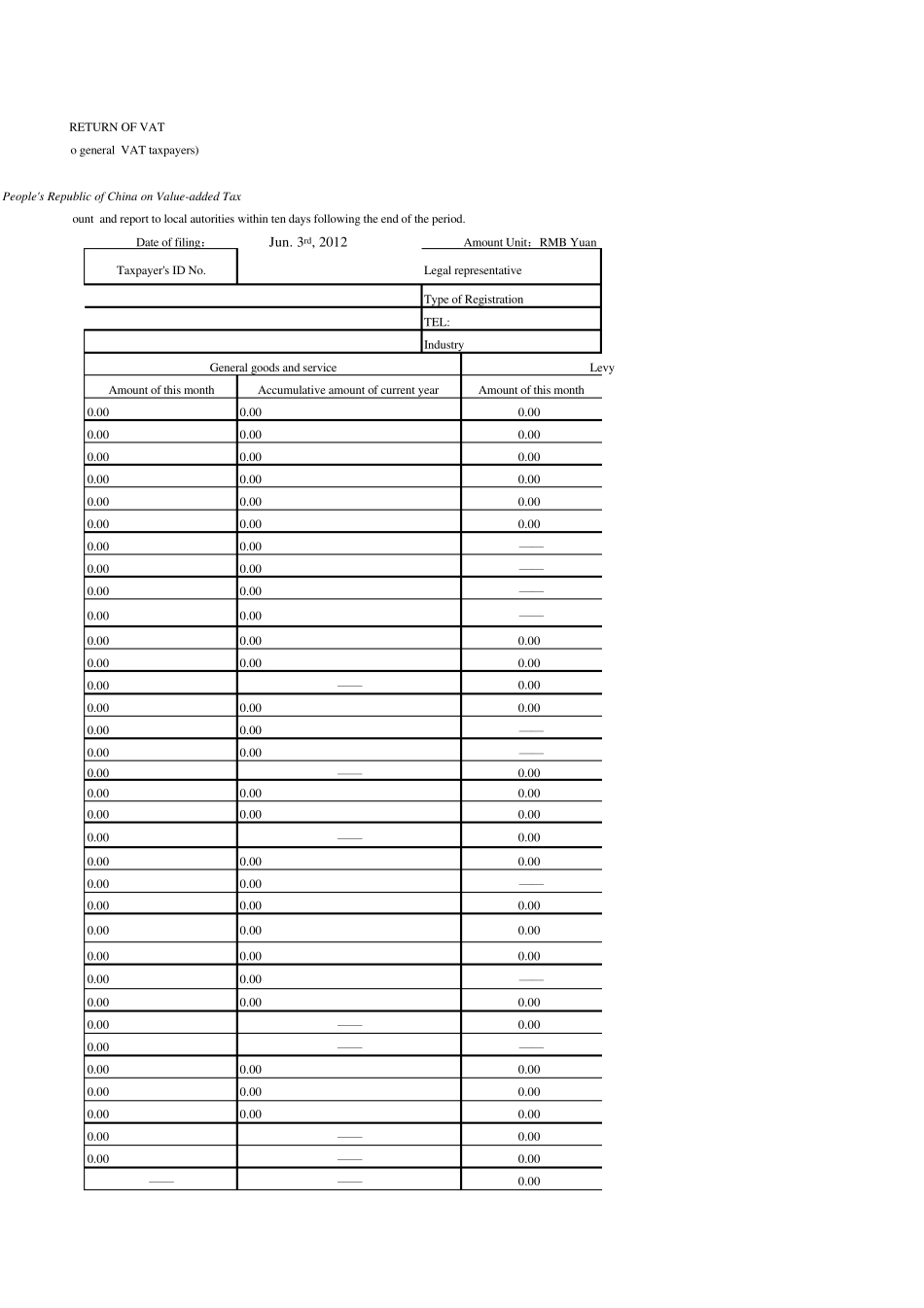

This form is formulated in accordance with the conditions defined in the Article 22 and Aticle 23 of The Provinsional Regulations of the People's Republic of China on ValuAll taxpayers should complete this form in accordance with the assessable period determined by the compentent autorities whether or not there is sale amount Taxation period:May. 2012Taxpayer's nameRegistration address Business address Account opening bank TAX RETU(Applicable to geneF23026 Huocheng county Sixty regimentF23026 Huocheng county Sixty regimentAccount NumberActual tax credits of levy-refund35Overdue tax (Refundable tax)this month34=24-28-29Including:outstanding tax 33=25+26-27④ Outstanding tax amount paid in this month31Underpaid tax at the end of this month (overpaid tax is negative)32=24+25+26-27③Paying tax payable of last month in this month30①Prepaid tax in parts28Refund in special bill of payment issued for paid -in tax of export26Tax paymentUnderpaid tax at the beginning of this month(overpaid tax is negative)25Tax paid in this month27=28+29+30+31②Prepaid tax in Special bill of payment issued for export29Tax reduction amount of tax payable23Total tax payable 24=19+21-23Tax payable caculated by a simplified method21 Overdue tax payable after tax inspection through a simplified method22Tax payable19=11-18Tax retained end of this month20=17-18Total deductible tax 17=12+13-14-15+16Actual tax deductiable18Overdue tax payable after tax inspection caculated by applicable tax rate16Changover withholdings on VAT14Input tax12Tax calculationsOutput tax11Tax retained of last month13Refundable tax for Tax Exemption, Offset and Refund of goods15Sales of exempt goods9Sales of exempt services10Sales of export goods through "exemption,credit and refund "method7Sales ...